27+ rule of thumb for mortgage

Web Lenders usually require the PITI principle interest taxes and insurance or your housing expenses to be less than or equal to 25 to 28 of monthly gross income. Take Advantage And Lock In A Great Rate.

Mortgage Affordability The Rule Of Thumb For Mortgage Amounts

Comparisons Trusted by 55000000.

. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. On the other hand if you are already on a 55.

The 30 rule recommends you find a place with a rental fee that. Browse Information at NerdWallet. Reasons You Should Consider Refinancing The Pros and Cons of.

Web Rule of Thumb for Adjustable-Rate Mortgages How Long Does It Take To Refinance a House. Lock Your Rate Today. In this brief guide we are going to discuss the mortgage affordability rule.

Web A good affordability rule of thumb is to have three months of payments including your housing payment and other monthly debts in reserve. Ad Purchase and refinance home loans. Principal interest taxes and insurance.

Ad 10 Best Home Loan Lenders Compared Reviewed. Lenders prefer you spend 28 or less of your gross monthly. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Ad See what your estimated monthly payment would be with the VA Loan. Ad Purchase and refinance home loans. Web Front-end DTI measures how much of your monthly gross pre-tax income goes toward your mortgage payment both principal and interest property taxes and mortgage.

The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. If youre following this general rule you shouldnt spend more than 28 of your gross income what you take home before taxes on your mortgage.

Use NerdWallet Reviews To Research Lenders. Get Instantly Matched With Your Ideal Mortgage Lender. Web The 28 rule.

Web The 2836 rule is a common rule of thumb for DTI. Web That said the refinance breakeven period time to recoup your upfront closing costs is very short here. Web The 32 rule covers all of your financial obligations such as mortgage payments homeowners insurance property taxes homeowners association fees etc.

Ad Learn More About Mortgage Preapproval. No application processing or underwriting fees. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Save Real Money Today. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. The key is to.

Web Mortgage affordability rule of thumb A guide By HuutiMoney Updated on Apr 22 2022. This will allow you to cover your. So we dont need to follow that 2 lower rate refinance.

Web You can cut the length of your mortgage by half with a slight change in your monthly payment from 1609 to 1634. Web Keep in mind that lenders prefer your mortgage payment plus taxes and insurance payments to be less than or equal to 25 to 28 of your gross monthly. Web How much of your income should go to rent.

Consider the 30 rule of thumb when it comes to rent. However many lenders let borrowers exceed 30. No application processing or underwriting fees.

Cost Handbook Vietnam 2014 Langdon Seah Vietnam Co Ltd Pdf Pdf Concrete Reinforced Concrete

5 Tips For First Time Home Buyers What I Wish I Had Known

Ycmnxgcamzdyym

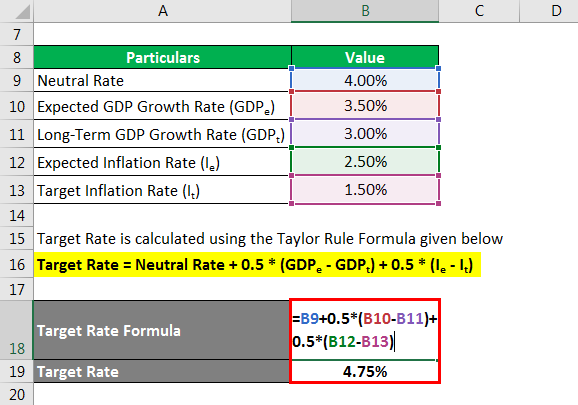

Taylor Rule Formula Calculator Example With Excel Template

:max_bytes(150000):strip_icc()/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png)

What Is The 28 36 Rule Of Thumb For Mortgages

What You Need To Know About Group Health Insurance Forbes Advisor

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Grand Forks Gazette March 27 2013 By Black Press Media Group Issuu

Four Financial Thumb Rules You Can Follow Mint

Mortgage Affordability The Rule Of Thumb For Mortgage Amounts

Can You Afford That House The 30 Rule Explained Walletgenius

:max_bytes(150000):strip_icc()/analyzing-the-expenses-836794228-5b47a5f746e0fb0037ff1b96.jpg)

What Is The 28 36 Rule Of Thumb For Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

What Is The 28 36 Rule And How Does It Affect My Mortgage The Motley Fool

Regulator Warns Lenders Against Suspending Credit Cards For All Those In Persistent Debt

Mortgage Affordability The Rule Of Thumb For Mortgage Amounts

Exit Prestige Luxury Realty 228 388 5888 2022 Agent On Boarding Manual By Tashia Mcginn Issuu